Dental implants are a life-changing solution for those with missing teeth, offering a permanent, natural-looking replacement that can restore both function and confidence. However, the cost of this advanced dental procedure often leads to a crucial question: Will my insurance cover dental implants? This comprehensive guide will explore the intricacies of insurance coverage for dental implants, helping you navigate the financial aspects of this transformative treatment.

Understanding Dental Implants and Their Costs

Before delving into insurance coverage, it’s essential to understand what dental implants are and why they can be a significant investment.

What Are Dental Implants?

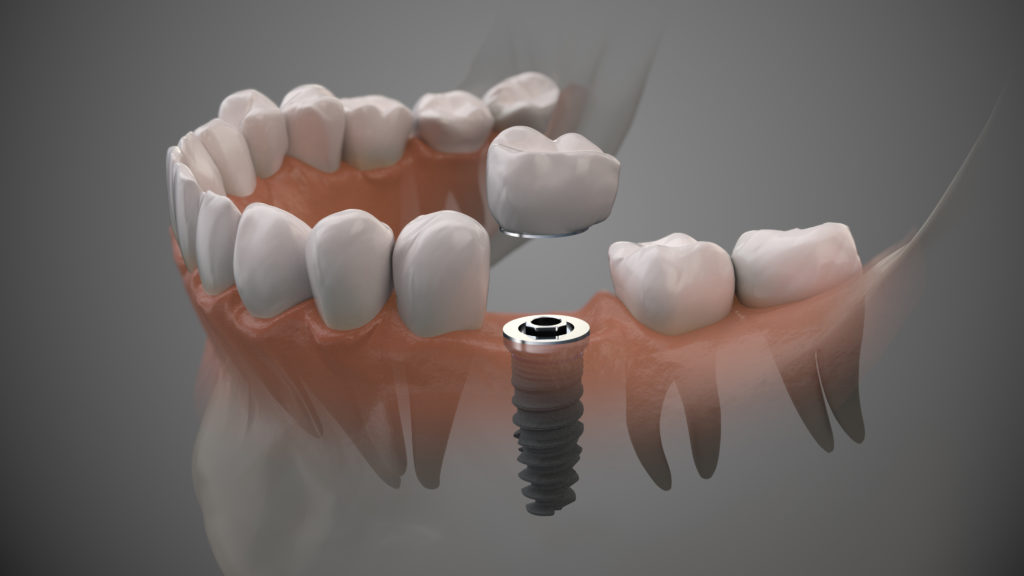

Dental implants are artificial tooth roots surgically placed into the jawbone to support replacement teeth. They consist of three main components:

- The implant: A titanium post that acts as the root

- The abutment: A connector that supports the crown

- The crown: The visible part that looks like a natural tooth

Types of Dental Implants

There are several types of dental implants, each designed to address specific tooth loss scenarios:

- Single tooth implants

- Multiple tooth implants

- Full arch replacements (e.g., All-on-4)

- Implant-supported bridges

Factors Affecting Dental Implant Costs

The cost of dental implants can vary significantly based on several factors:

- Number of implants needed

- Type of implant and materials used

- Necessity for additional procedures (e.g., bone grafting)

- Geographic location of the dental practice

- Dentist’s experience and expertise

On average, a single dental implant can cost between $3,000 to $4,500, including the implant, abutment, and crown. Full mouth reconstructions using implants can range from $60,000 to $90,000 or more.

Does Insurance Cover Dental Implants?

The short answer is: it depends. Insurance coverage for dental implants has historically been limited, but this is changing as more insurance providers recognize the long-term benefits of implants.

The Dental Insurance Landscape

Traditionally, many dental insurance plans have considered implants to be a cosmetic procedure, thus not covering them. However, this perception is shifting as the medical necessity of implants becomes more widely acknowledged.

When Medical Insurance May Cover Implants

In some cases, medical insurance may cover dental implants if they’re deemed medically necessary. Situations where this might apply include:

- Tooth loss due to trauma or accident

- Congenital conditions affecting tooth development

- Certain medical conditions that impact oral health

Types of Dental Insurance Plans

Different types of dental insurance plans may offer varying levels of coverage for implants:

- Dental Health Maintenance Organizations (DHMOs)

- Preferred Provider Organizations (PPOs)

- Indemnity Plans

PPOs and Indemnity Plans typically offer more flexibility in choosing providers and may be more likely to offer some level of implant coverage.

Maximizing Your Insurance Benefits

To make the most of your insurance benefits for dental implants, consider the following strategies:

Decoding Your Dental Insurance Policy

Understanding the key terms in your policy is crucial:

- Annual maximum: The total amount your plan will pay in a year

- Deductible: The amount you must pay before insurance coverage kicks in

- Coinsurance: The percentage of costs you’re responsible for after meeting your deductible

- Waiting periods: The time you must wait before certain procedures are covered

Tips for Finding an Implant Dentist in Your Network

- Check your insurance provider’s website for in-network dentists

- Ask for recommendations from your general dentist

- Verify the dentist’s experience with implant procedures

Negotiating with Your Insurance Provider

Don’t be afraid to advocate for yourself. Here are some steps you can take:

- Request a pre-determination of benefits

- Appeal denials with supporting documentation from your dentist

- Highlight the medical necessity of the procedure

Utilizing Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

FSAs and HSAs can be valuable tools for covering dental implant costs:

- FSAs allow you to set aside pre-tax dollars for medical expenses

- HSAs offer similar benefits but with the added advantage of rollover funds

Alternative Financing Options for Dental Implants

If insurance coverage is limited or unavailable, consider these alternative financing options:

Dental Implant Financing Plans

Many dental offices offer in-house financing or partner with third-party lenders to provide payment plans. Options may include:

- Interest-free plans for short-term financing

- Extended payment plans with competitive interest rates

Dental Savings Plans

Dental savings plans are not insurance but can offer discounts on dental procedures, including implants. Members pay an annual fee to access a network of dentists offering reduced rates.

Crowdfunding and Charitable Organizations

For those facing financial hardship, crowdfunding platforms or dental charities may provide assistance. Some organizations specifically focus on helping individuals access necessary dental care.

Making Informed Decisions About Dental Implants

When considering dental implants and navigating insurance coverage, it’s important to be well-informed and proactive.

Questions to Ask Your Dentist and Insurance Provider

- What is the total cost of the implant procedure, including any additional treatments?

- What percentage of the cost will my insurance cover?

- Are there alternative treatments that may be covered more extensively?

- Can the procedure be phased to spread costs over multiple benefit years?

Weighing the Long-Term Benefits of Implants

While the upfront cost of implants can be significant, they often prove to be a cost-effective solution in the long run. Consider the following:

- Implants can last a lifetime with proper care

- They prevent bone loss and preserve facial structure

- Implants eliminate the need for frequent replacements associated with other options like dentures

Dr. Sarah Johnson, a prosthodontist with 15 years of experience, notes: “Dental implants are an investment in your oral health and overall well-being. While the initial cost may be higher than other options, the long-term benefits often outweigh the expense.”

The Future of Dental Implant Insurance

As dental implants become more common and their benefits more widely recognized, insurance coverage is likely to evolve.

Trends and Predictions

Industry experts predict that more insurance providers will expand their coverage for dental implants in the coming years. This shift is driven by:

- Increasing demand for implants

- Growing recognition of implants as a standard of care

- Long-term cost savings associated with implants compared to other tooth replacement options

Advocating for Improved Coverage

Patients can play a role in shaping the future of dental implant coverage:

- Share your experiences with your insurance provider

- Participate in surveys and feedback opportunities

- Support advocacy groups working to improve dental care access

Conclusion

Navigating insurance coverage for dental implants can be complex, but understanding your options is crucial for making informed decisions about your oral health. While insurance coverage for implants is still limited, there are various strategies and alternatives to help make this life-changing procedure more accessible.

Remember to thoroughly research your insurance benefits, explore all financing options, and consult with experienced dental professionals to determine the best path forward. With proper planning and advocacy, you can take significant steps towards achieving the healthy, confident smile you deserve.

Don’t let insurance limitations deter you from exploring dental implants as a solution. Schedule a consultation with a qualified implant dentist today to discuss your options and start your journey towards a restored smile.